Forex day trading offers a wealth of opportunities for traders to capitalize on short-term price movements in the currency markets. Engaging in Forex day trading requires not just a solid understanding of market dynamics, but also a robust strategy to manage risks and take advantage of potential profit. If you’re new to Forex trading or looking to refine your skills, forex day trading ZAR Trading can provide valuable insights and resources to guide your journey. This article will delve into the core principles of Forex day trading, effective strategies, and essential tips to achieve success.

Understanding Forex Day Trading

Forex day trading refers to the practice of buying and selling currency pairs within a single trading day. Unlike long-term investors who hold onto assets for weeks, months, or even years, day traders aim to profit from small price fluctuations over short periods. This trading style requires quick decision-making, a keen sense of market timing, and adherence to a planned trading strategy.

Key Concepts in Forex Day Trading

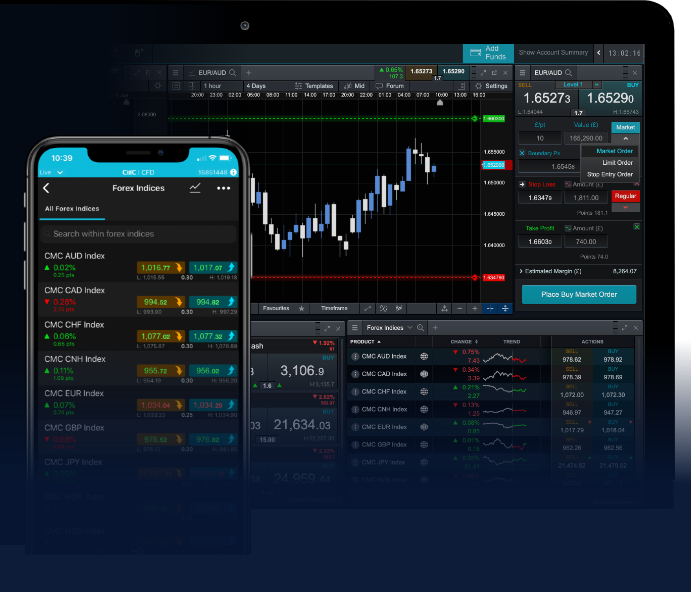

Candlestick Charts

Candlestick charts are a cornerstone of Forex day trading. These graphs represent price movements in a given time frame, allowing traders to visualize trends and reversals more effectively. A single candlestick provides four critical data points: the opening price, the closing price, the highest price, and the lowest price within the chosen period. Learning to read candlestick patterns can significantly improve a trader’s ability to make informed decisions.

Leverage

Leverage is a powerful tool in Forex trading, allowing traders to control larger positions with smaller amounts of capital. For instance, a leverage ratio of 100:1 means that for every dollar a trader has, they can trade up to 100 dollars. While leverage can amplify profits, it can equally magnify losses. Therefore, it’s crucial to use leverage cautiously and understand the associated risks.

Risk Management

Effective risk management is vital for any trader’s longevity in the Forex market. A good rule of thumb is to risk only 1-2% of your trading capital on a single trade. Implementing stop-loss orders can help limit potential losses and protect gains. Additionally, traders should always be aware of market news and events that could influence currency fluctuations, leading to unexpected volatility.

Developing a Day Trading Strategy

Creating a successful day trading strategy involves several critical components:

1. Define Your Goals

Establish clear objectives, including your desired profit targets and acceptable risk levels. Setting realistic expectations can help you maintain discipline and stay focused during your trading sessions.

2. Choose the Right Currency Pairs

Not all currency pairs are created equal. Focus on pairs with higher liquidity and volatility, as they tend to offer more trading opportunities and tighter spreads. Major pairs, such as EUR/USD and USD/JPY, are often favored due to their consistent price movements and the availability of information.

3. Implement Technical Analysis

Utilize indicators and tools to conduct technical analysis. Popular tools include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). These can help identify trends, overbought or oversold conditions, and potential reversal points.

4. Backtesting

Before executing a strategy in live markets, conduct backtesting to assess its historical performance. Analyze past trades to understand how the strategy would have performed under various market conditions, allowing for adjustments and refinements before trading with real money.

Trading Psychology

The mental aspect of trading is often overlooked but is crucial for success. Day traders must develop emotional discipline to avoid making impulsive decisions based on fear or greed. Keeping a trading journal helps track your thoughts and feelings during trades, enabling you to identify patterns and improve your psychological approach over time.

Staying Informed

In the fast-paced world of Forex trading, staying updated on market news and economic data is essential. Economic indicators such as employment reports, consumer confidence indexes, and central bank interest rate announcements can significantly impact currency prices. Using an economic calendar can help traders prepare for upcoming events that may influence their trades.

Conclusion

Forex day trading can be a rewarding venture for those willing to invest the time and effort to learn the ropes. By understanding key concepts, developing a solid trading strategy, managing risk effectively, and maintaining a disciplined mindset, traders can increase their chances of success in this competitive market. Remember, practice and continuous learning are essential components of becoming a proficient Forex day trader. Take advantage of resources available through platforms like ZAR Trading to enhance your market knowledge and trading skills.